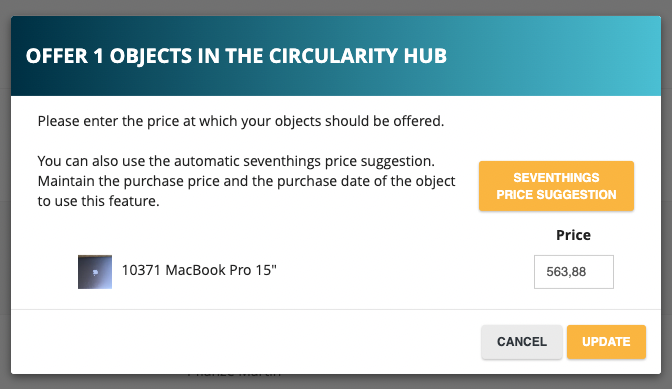

When selling to your employees, we offer you an automatic calculation of the resale value of your items. Learn more about it here.

The seventhings price proposal calculates the resale value of the inventory at the usual market price. For this purpose, an algorithm is used that depreciates the original purchase price of the inventory over its age and thus calculates the resale value.

Why is the market (resale) price important for the sale of the inventory?

In the event of a sale below the value of an inventory, a non-cash benefit is claimed by the purchaser. This must be deducted accordingly via payroll tax. The amount of the imputed income is not determined by the residual book value after depreciation, but by the current market value of the inventory.

Since researching this market value can be very time-consuming and difficult, we have automated this process and taken over the research for you.

How does the seventhings price suggestion work?

To use the seventhings price proposal the following data must be entered:

- Category of the inventory (IT, furniture, ... etc.)

- original acquisition price

- acquisition date

Resale value IT

- in the first year, IT equipment loses an average of 33% in value

- in each subsequent year, it loses an average of 7% in value again

(Source: Own research on smartphones, laptops, tablets etc. on most common german market places like ebay and idealo)

Resale value furniture & other inventory

- in the first year average inventory loses 25% in value

- in each subsequent year it loses 5% in value again on average

(Source: WikiHow, Used-Design)

Note:

- For well preserved inventories of well-known brands and designer pieces, the seventhings price suggestion should be increased manually by 5%.

- For damaged inventories, the seventhings price suggestion should be reduced by 5% per damage.

- For inventories of unknown brands the seventhings price suggestion should be reduced by 5%.

Example

The following algorithm is used to calculate the residual value, which we will illustrate with an example:

- Category = Furniture

- AP = Acquisition price = 4260€

- acquisition date = 01.05.2020

- t= 840 days since acquisition

- DY1 = depreciation year 1 (33 % for IT, 25 % for all other inventories)

- DY2 = depreciation year 2 (7 % for IT, 5 % for all other inventories)

Answer for RW of a piece of furniture = resale value RV:

Year = t / 365,25 Days

Year < 1 --> RV = AP - (AP * DY1)

RV = RV previous year * (AP - (AP * DY2 * Years)

RV = 2731,72 €